Research Symposium

23rd annual Undergraduate Research Symposium, April 6, 2023

Aden Annane Poster Session 3: 2:45 pm - 3:45 pm/ Poster #51

BIO

I'm a sophomore here at FSU double-majoring in economics and computer science, and minoring in business analytics. I grew up in Miami, FL and I'm a big Florida Panthers fan. I find mergers, acquisitions, and capital markets very interesting and want to work with them in my career. This summer I'll be joining Goldman Sachs as a Global Markets Summer Analyst, and I hope to use my research experience to help develop my skillset in finance. Outside of school, you can find me boxing at the gym or mountain biking.

SPACs, IPOs, and Social Media: A Comparative Study of Public Listing Options

Authors: Aden Annane, David KingStudent Major: Economics, Computer Science

Mentor: David King

Mentor's Department: Management Mentor's College: College of Business Co-Presenters:

Abstract

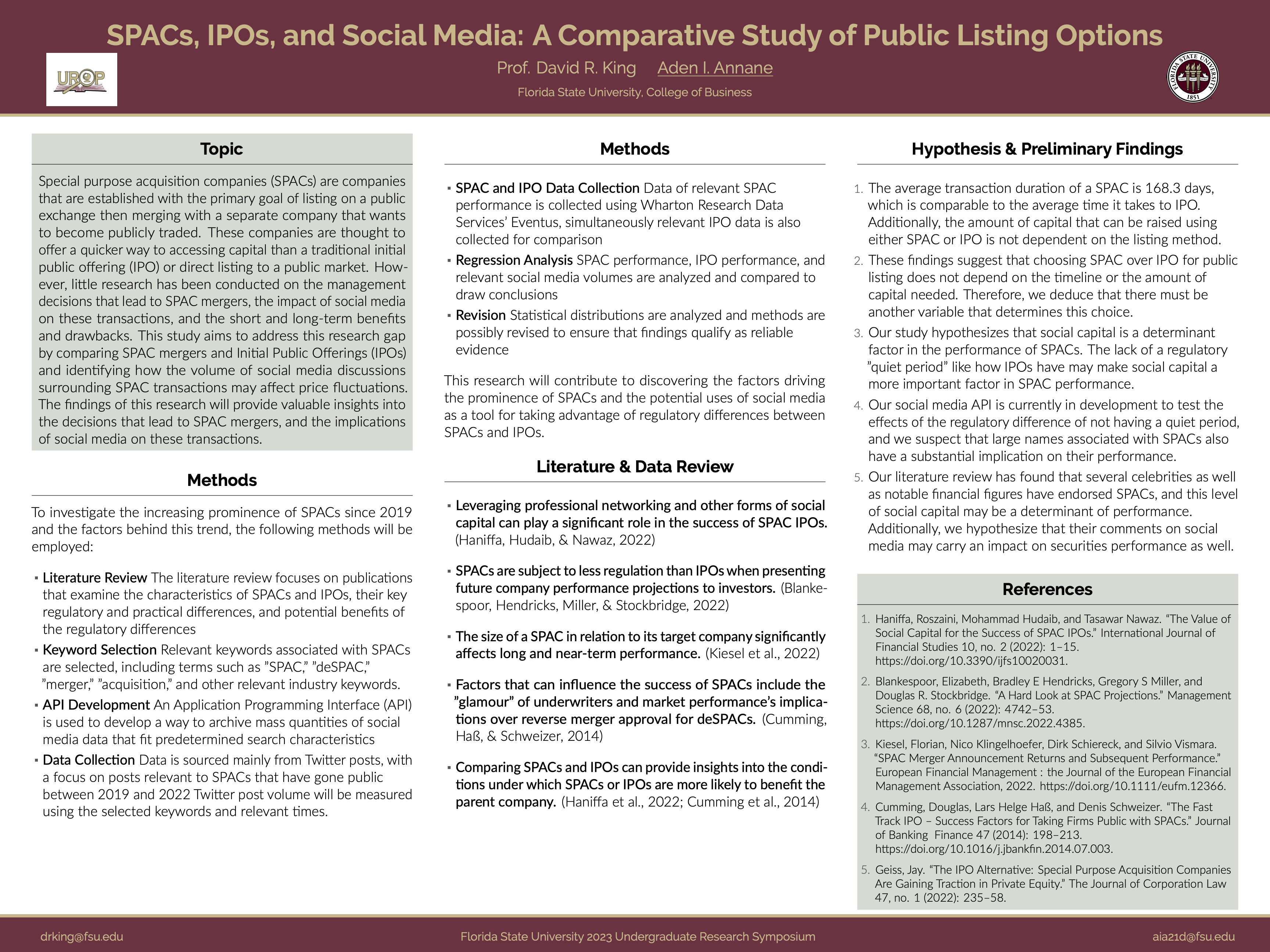

Special Purpose Acquisition Companies (SPACs) are gaining popularity as a way for companies to access public listings on global equity markets and increase their capital base for business expansion. However, little research has been conducted on the management decisions that lead to SPAC mergers, the impact of social media on these transactions, and the short and long-term benefits and drawbacks.

This study aims to address this research gap by comparing SPAC mergers and Initial Public Offerings (IPOs) as public listing options and identifying the conditions under which each option is more likely to benefit the parent company. The study identifies five public listing goals and variables that affect the most beneficial mechanism for corporate public listing, such as time-efficient access to capital, maximizing capital fundraising, sizable business valuation, sustained market volume, and positive long-term market performance.

Moreover, the study examines how the volume of social media discussions surrounding SPAC transactions may affect price fluctuations pre- and post-deSPAC. The findings of this research will provide valuable insights into the management decisions that lead to SPAC mergers, the regulatory expectations of SPACs versus IPOs, and the implications of social media on these transactions. The study will be of interest to companies, investors, and regulators seeking to navigate the complex landscape of public listing options in a rapidly changing market. Additionally, the study highlights areas for future research, including the impact of retail interest on the pricing of SPACs with high volume.

Keywords: Stock Market, SPAC, IPO, Equity Capital Markets, Mergers & Acquisitions