Research Symposium

25th annual Undergraduate Research Symposium, April 1, 2025

Alexander Kajda Poster Session 3: 1:45 pm - 2:45 pm/ Poster #23

BIO

Alexander, a Senior majoring in Computer Science, B.S, with a minor in Statistics at Florida State University, is the manager for the Data Analytics Group at the Devoe L. Moore Center. Prior to that, Alexander worked a number of internships relating to Data and Computer Science to build experience. Along with this, during his time at FSU, Alexander has earned a SAS certificate for Programming and Data Analysis along with working on various other projects relating to Programming and Computer Science.

An Analysis of Florida’s Investor-Owned Single-Family Homes

Authors: Alexander Kajda, Crystal TaylorStudent Major: Computer Science

Mentor: Crystal Taylor

Mentor's Department: Philosophy, Economics, City/Urban Planning Mentor's College: Florida State University Co-Presenters: Joseph Duran

Abstract

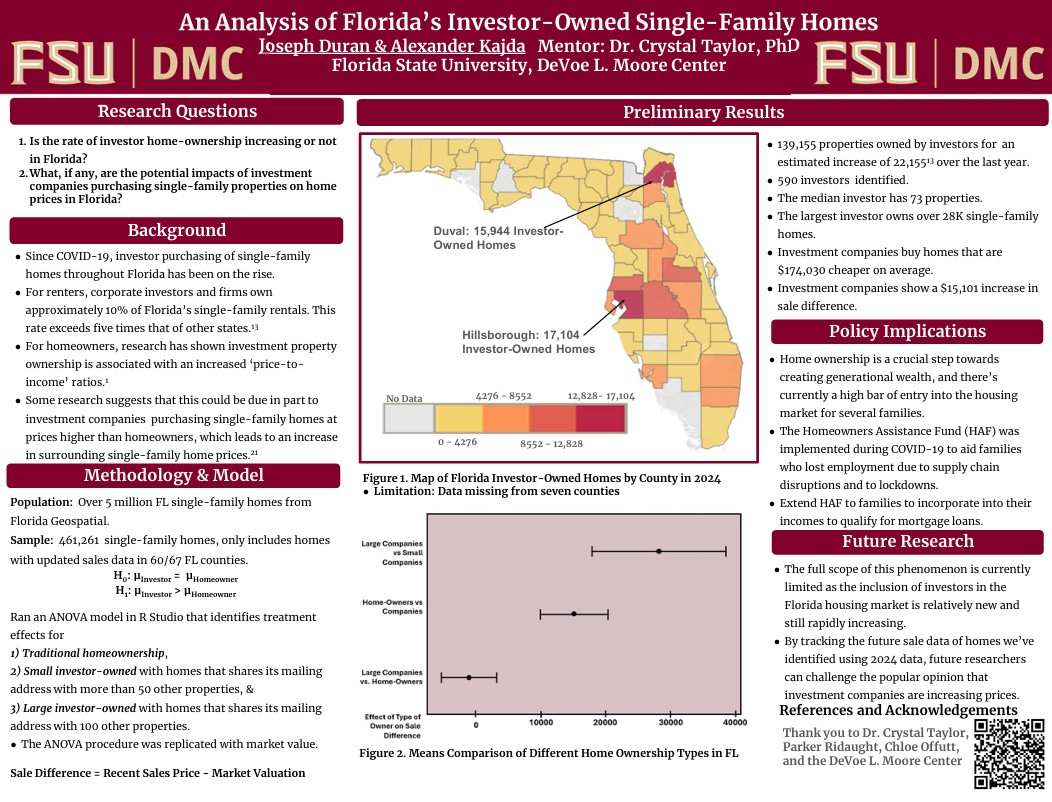

More than ten percent of Florida’s single-family rentals are investor-owned properties (Simonton, 2024). We examine how investor-owned properties could potentially contribute to the rising costs associated with homeownership. We ask two questions, “Is the rate of investor home ownership increasing or not in Florida, and what are the potential impacts of their market share increasing?” We used a dataset containing 5.5 million observations with every single-family home in Florida provided by Florida Geospatial.

Our model assumes that an increase in home prices relative to investors can be attributed to the number of investor purchases and the extent to which investors are willing to pay more than consumers. In addition, we have also identified purchasing habits of investment companies and the mechanisms they use to compete with home buyers.

We identified a total of 139,155 homes owned by investment companies, an increase of 22,155 over the last year. Our regression model revealed that investment companies spend $4,261 more on homes than families, relative to the market value of the home. From our results, we concluded that investment companies play a much smaller role than anticipated in increasing home prices.

We recommend a program like the Homeowner Assistance Fund which was responsible for billions of dollars in aid given to families struggling to meet their mortgage payments due to the pandemic. Future research should continue to examine the role of investor-owned homes in the housing market and track the potential impact of resale of these investor-owned properties over time.

Keywords: Investor, Single-Family, Florida, Housing, Policy