Research Symposium

25th annual Undergraduate Research Symposium, April 1, 2025

Daniel Nkeumbang Kenvo Poster Session 2: 10:45 am - 11:45 am/ Poster #105

BIO

I am a first-year student from Bethesda, Maryland, majoring in Finance. It has been an honor to work under the mentorship of Dr. Luke Rodgers. I plan to graduate with an MBA in May 2028 and aspire to pursue a career in investment banking, private equity, or portfolio management, with the long-term goal of starting my own business. I am currently a member of Securities Society, a rush mentor in the Interfraternity Council, and a research assistant through the Undergraduate Research Opportunity Program (UROP).

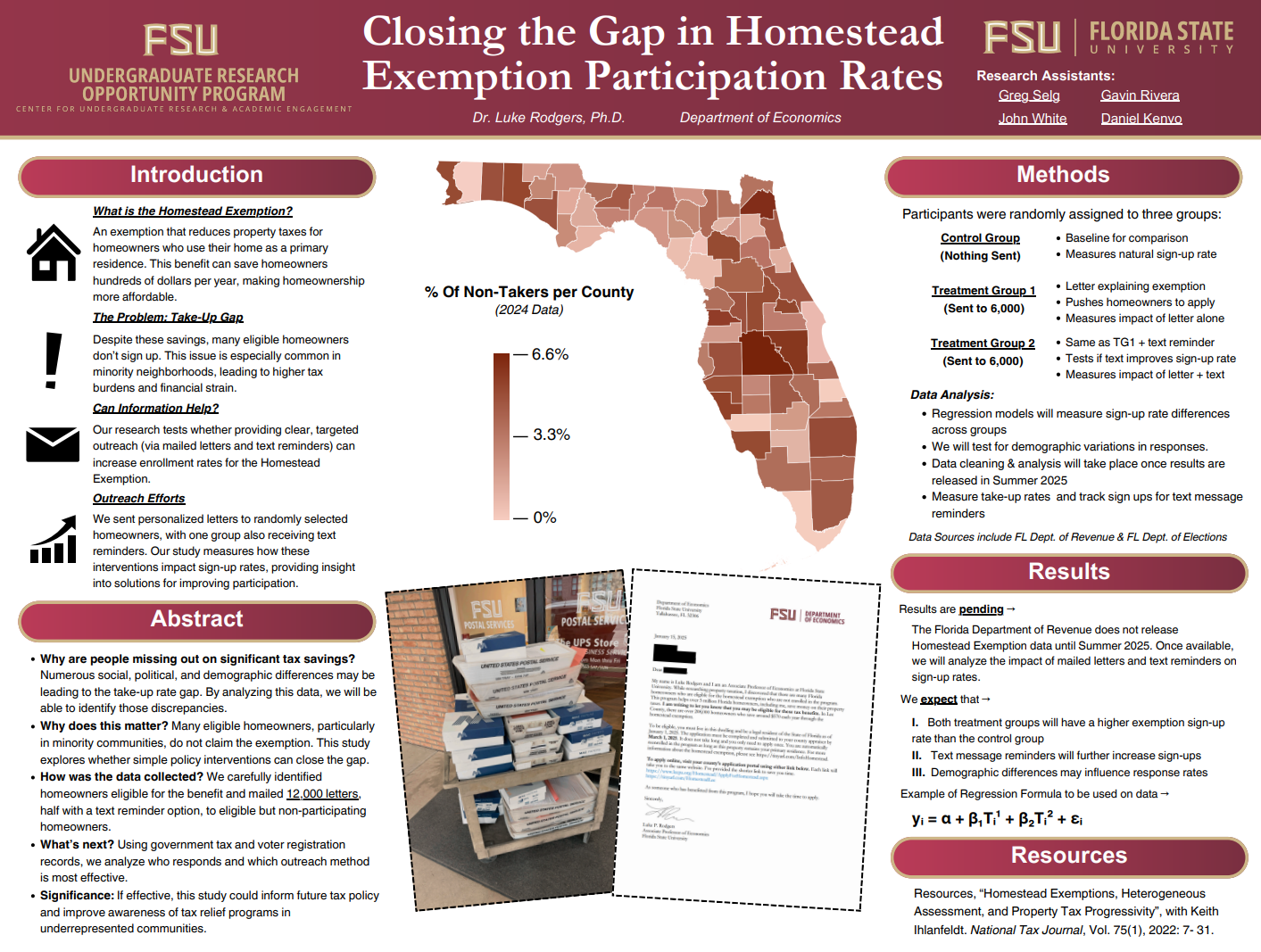

Closing the Gap in Homestead Exemption Participation Rates

Authors: Daniel Nkeumbang Kenvo, Dr. Luke RodgersStudent Major: Finance

Mentor: Dr. Luke Rodgers

Mentor's Department: Economics Mentor's College: Social Sciences and Public Policy Co-Presenters: Greg Selg, Gavin Rivera, John White

Abstract

Many eligible homeowners miss out on significant tax savings due to various social, political, and demographic factors that contribute to disparities in homestead exemption take-up rates. By analyzing these discrepancies, this study aims to understand the barriers preventing homeowners from claiming the exemption and assess whether simple policy interventions can help close the gap.

A major concern is that minority communities are disproportionately affected, as many eligible homeowners fail to claim the benefit. To investigate potential solutions, we conducted a large-scale field experiment by identifying 12,000 eligible but non-participating homeowners and sending them informational letters. Half of the recipients also received an optional text message reminder to further encourage action.

To measure the effectiveness of these interventions, we will analyze government tax and voter registration records to determine which homeowners respond and which outreach method proves most successful. This approach allows us to assess whether direct communication and reminders can meaningfully increase participation in the homestead exemption program.

If effective, this study could provide valuable insights for policymakers, helping to improve the design and outreach of tax relief programs. By increasing awareness and participation in underrepresented communities, these findings have the potential to reduce financial burdens on vulnerable homeowners and promote more equitable access to tax benefits.

Keywords: tax, florida, exemptions, policy, experiment