Research Symposium

25th annual Undergraduate Research Symposium, April 1, 2025

Ronan McKenna Poster Session 3: 1:45 pm - 2:45 pm/ Poster #197

BIO

I grew up in Ireland and the UK before moving to Tampa, FL for high school, where I now reside. I’m currently a sophomore pursuing a double major in Finance and Management Information Systems. My research focus is on FinTech development, and this summer, I’ll be completing a FinTech Consulting Internship in London, UK.

Microfinance and Modern Technology: AI-enabled technologies used by MFIs and their impact on product developers, lenders, and borrowers.

Authors: Ronan McKenna, Paromita SanyalStudent Major: Dual Major: MIS and Finance

Mentor: Paromita Sanyal

Mentor's Department: Sociology Mentor's College: Harvard University Co-Presenters: Thomas Crowley

Abstract

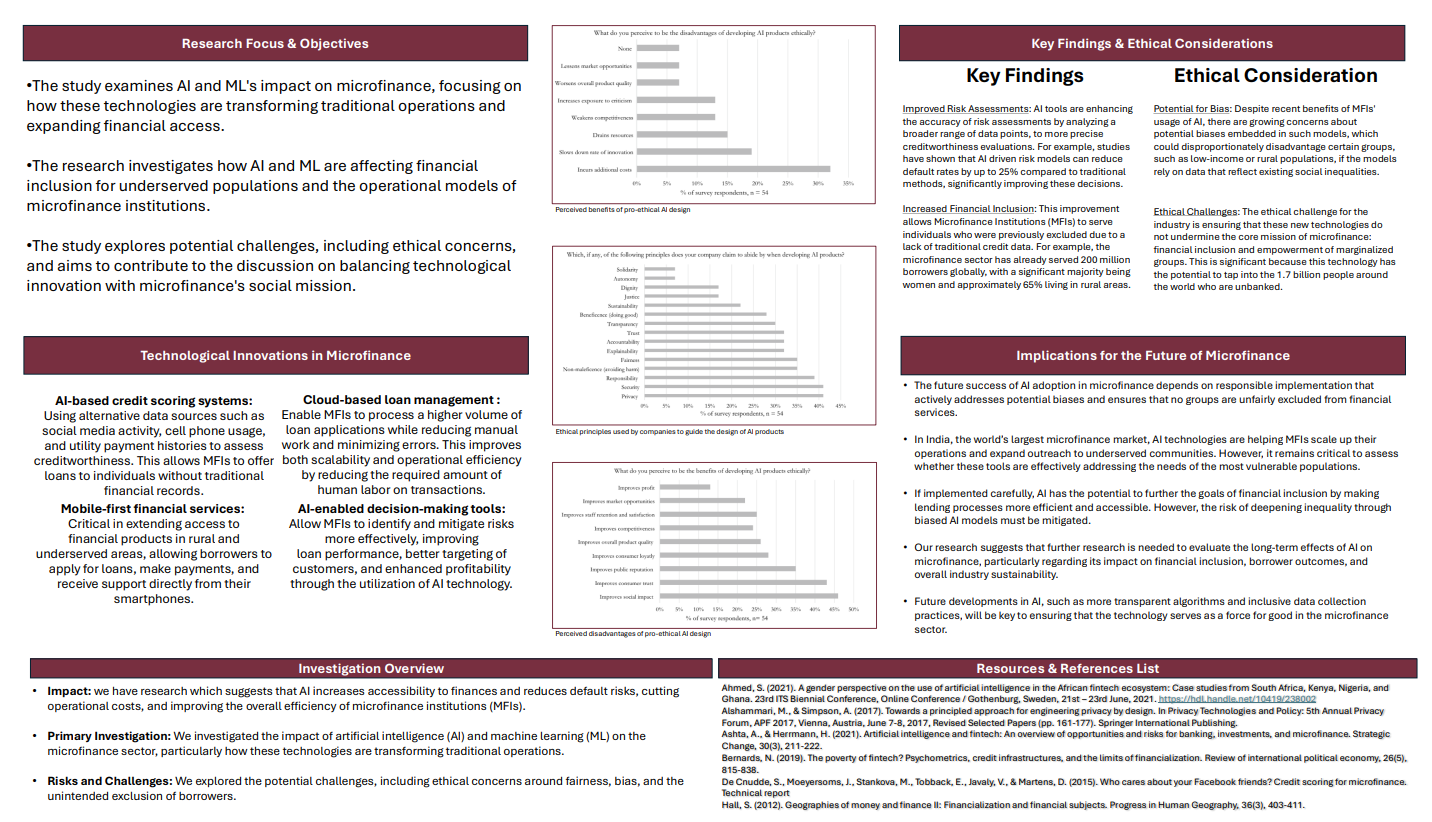

The inclusive finance sector, which aims to serve disadvantaged populations through financial innovations like microfinance and mobile money, is undergoing a major transformation due to the integration of technologies such as artificial intelligence (AI) and machine learning (ML). Traditionally focused on relationship-based lending, the sector is becoming increasingly technology-driven. This literature review explores (a) the types of AI-enabled systems being introduced in inclusive finance and (b) how they are reshaping micro-lending institutions by expanding markets, increasing borrower access, reducing default risks, and maintaining profitability. Key innovations include AI-based credit scoring models that analyze non-traditional datasets, such as social media activity and mobile usage, to assess creditworthiness for individuals lacking conventional financial histories. Cloud-based loan management platforms are streamlining operations, allowing microfinance institutions to process applications more efficiently, while mobile-first financial services are extending access to underserved populations in rural areas. Despite their promise, these technologies raise ethical concerns about fairness and bias in AI-driven lending practices. The sector faces the challenge of balancing technological progress with its core mission of financial inclusion. This review outlines the current state of these innovations, mapping where they are being adopted, regulatory developments, and the ethical issues being debated. As the use of AI in inclusive finance is an emergent trend, understanding its contours is essential to identifying areas for further investigation.

Keywords: AI, Lending, FinTech, Credit