Research Symposium

24th annual Undergraduate Research Symposium, April 3, 2024

Noah Berg Poster Session 4: 2:45 pm - 3:45 pm /361

BIO

Hello, my name is Noah Berg and I'm a 2nd year student from Tampa, Florida. Although I originally went into college only wanting to study economics, I quickly found that the world of finance captivated me in a way no other discipline has. At first it started with investing whatever savings I had in simple stocks and index funds but has rapidly evolved into advanced research into different financial instruments that exist in our institutions. I'm specifically interested in research concerning mutual funds, market operations, economic forecasting, private equity, and banking. Working with Dr. Kim has been an honor and an insightful glimpse into the world of finance research. This project has truly ignited a passion for finance which I hope to harness into a productive career and a devoted effort to make the world a better place.

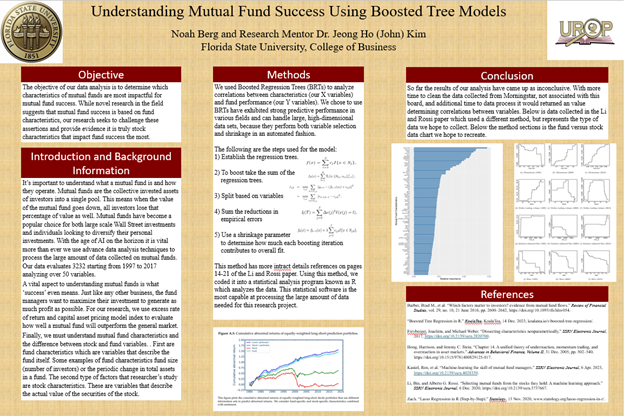

Understanding Mutual Fund Success Using Boosted Tree Models

Authors: Noah Berg, Dr. Jeong Ho KimStudent Major: Economics and Finance

Mentor: Dr. Jeong Ho Kim

Mentor's Department: Department of Finance Mentor's College: College of Business Co-Presenters:

Abstract

Mutual funds are a tool to pool money from multiple investors to invest in a diverse profile of assets including stocks, bonds, and other securities. The rapid growth of both the United States and international markets has made mutual funds a greater focus of research for finance research; yet, predicting them has proven to be a difficult task. Just like any other stocks, mutual funds value/success changes over a given period due to a variety of factors. These factors can be broken down into two core categories. First are fund characteristics which are variables that describe the fund itself. Some examples of fund characteristics include how long the fund has existed, fund size (number of investors), or the periodic change in total assets in a fund. The second type of factors that researcher’s study are stock characteristics. These are variables that describe the actual value of the securities of the stock. Researchers Ron Kanie et al. argue that the most important factors that predict mutual fund success a fund are fund characteristics, specifically fund flows and fund momentum. They came to this conclusion by utilizing neural networks, a type of AI analysis, to find which variables were the best predictors of success. Our research tries to answer the same core question of what predicts mutual fund success; however, we use a different method called boosted regression trees. This method will provide us with a more accurate conclusion about the true factors that drive mutual fund success. (REVISE)

Keywords: Finance, Mutual Funds, ETFs, AI, Stock Market