Research Symposium

24th annual Undergraduate Research Symposium, April 3, 2024

Morgan Braun Poster Session 5: 4:00 pm - 5:00 pm/311

BIO

Morgan Braun is a sophomore, majoring in Finance and minoring in Business Analytics at Florida State University. She is from Virginia, Beach, VA. Some of her research interests include topics within insurance and risk management and behavioral finance, relating to investment decision-making. She aspires to pursue her education past undergraduate studies by obtaining an MBA in the future. In addition, she is seeking a career in financial consulting upon graduation.

Changes in Average Premiums Based on Insurance Regulator Characteristics

Authors: Morgan Braun, Dana TelljohannStudent Major: Finance

Mentor: Dana Telljohann

Mentor's Department: Risk Management and Insurance Mentor's College: College of Business Co-Presenters:

Abstract

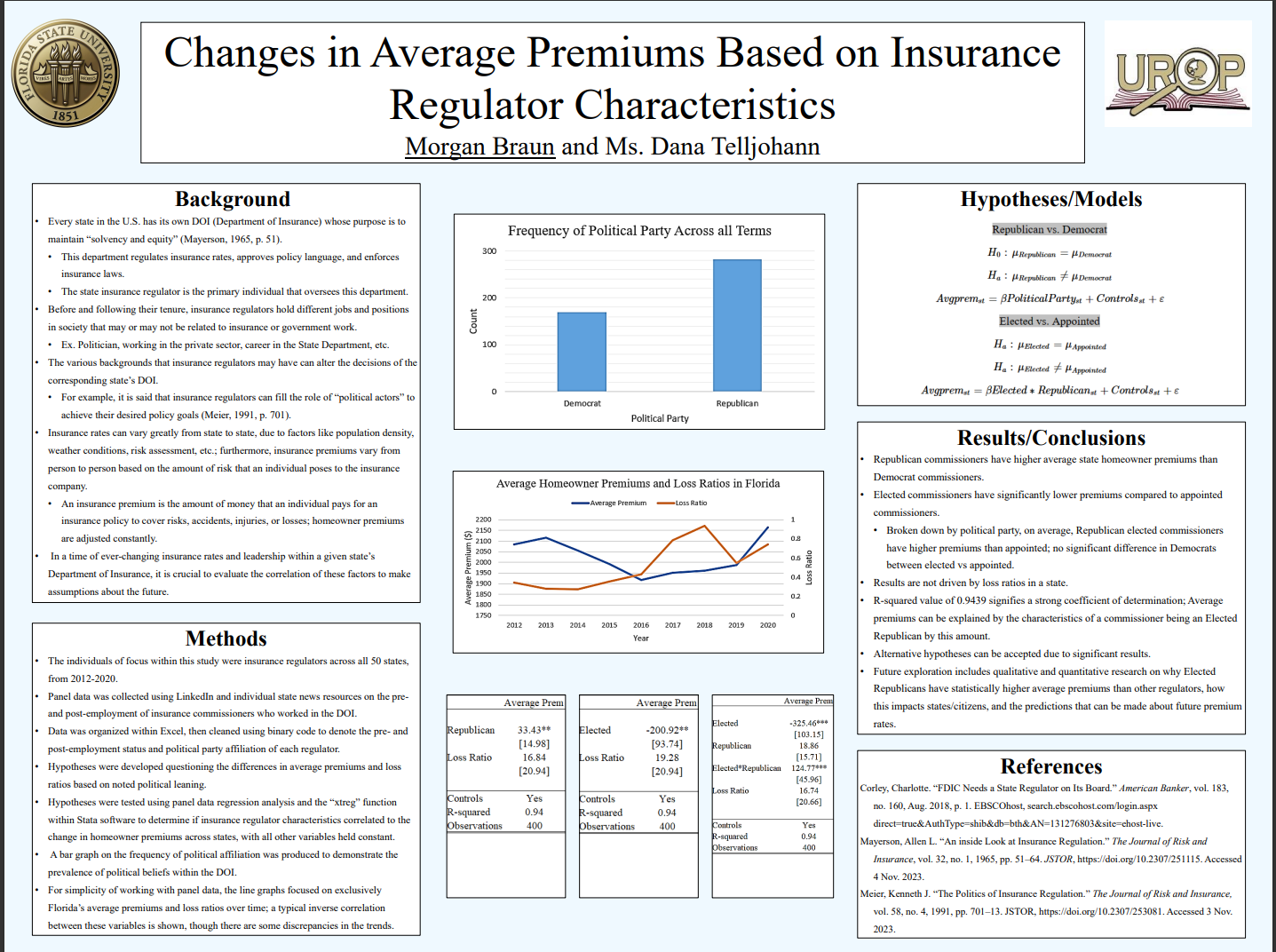

The insurance industry in America is responsible for employing nearly 3 million individuals. This includes each state’s Department of Insurance and Insurance Commissioner position, whose role is to uphold regulations, licensing, and consumer protection. These regulators can have varying characteristics and employment history, ranging from working in the private sector to being a politician. Additionally, political preference and elected/appointed status are important traits that differ across commissioners. Aside from the typical reasons that homeowner premiums fluctuate, such as weather conditions, population density, and risk assessment, the background of an insurance commissioner is a crucial factor to consider when exploring how homeowner premiums, or the payment one makes to ensure policy coverage on their residence, varies across states.

The purpose of this analysis is to determine how the background of an insurance commissioner correlates to each state’s premiums and loss ratios. More specifically, this project focuses on how political leanings may influence premium rates. Data on state insurance commissioners from 2012 – 2020 was collected through researching LinkedIn profiles and individual state news resources. This data was then compiled, organized, and cleaned within Excel. Stata, a statistical software package, was used to perform a series of linear regression tests that could predict the strength of a correlation between average premiums, political affiliation, and elected/appointed status. This project aims to provide consumers with more information about the insurance rates they encounter and to help predict future changes in premiums.

Keywords: insurance, political, government, characteristics, premium