Research Symposium

24th annual Undergraduate Research Symposium, April 3, 2024

Mehul Adwani Poster Session 4: 2:45 pm - 3:45 pm /232

BIO

I am sophomore at Florida State University majoring in Finance and Economics with a minor in Computer Science. Currently researching under professor Doug Norton, we are leading a study on manual tax withholding within the gig economy, focusing on Uber's market entry. Through meticulous analysis, we aim to inform critical policy discussions on taxation and voting behavior. Passionate about education, I hope to bring diverse skills and interests to the table.

The Impact of Manual Tax Withholding on Attitudes Toward Taxation and Voting Behavior in the Gig Economy: Uber's Market Entry

Authors: Mehul Adwani, Doug NortonStudent Major: Finance, Economics

Mentor: Doug Norton

Mentor's Department: Economics Mentor's College: College of Social Sciences and Public Policy Co-Presenters:

Abstract

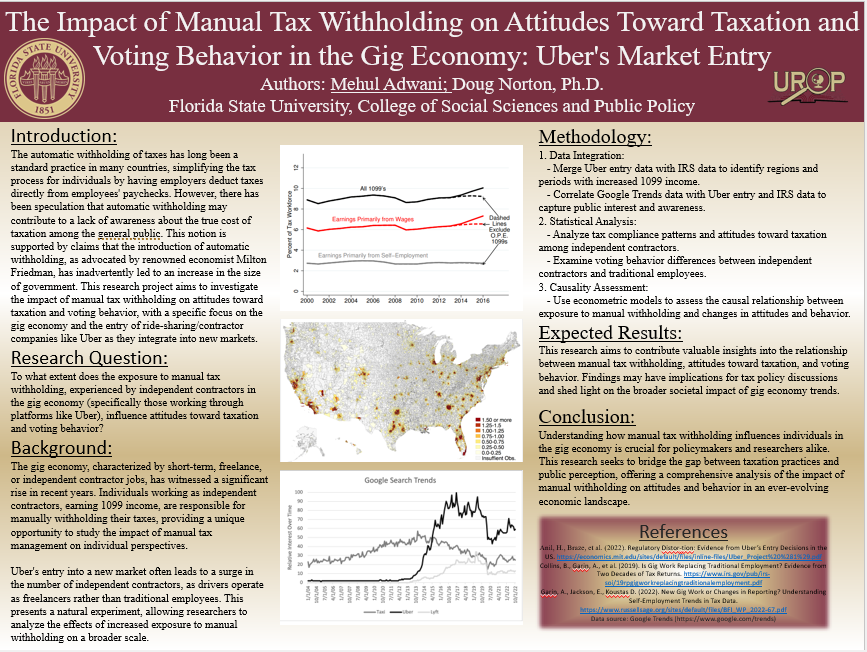

This study investigates how manual tax withholding affects attitudes toward taxation and voting behavior, focusing on the gig economy and Uber's entry into new markets. While automatic withholding simplifies tax procedures, concerns exist about its role in obscuring the true cost of taxation and potentially expanding government. The research question explores how exposure to manual withholding, experienced by gig economy workers, particularly Uber contractors, influences attitudes and voting behavior.

Using IRS data on independent contractors, Google Trends data on tax-related searches, and voter turnout data from regions affected by Uber's entry, the study employs statistical analysis and econometric models to discern causal relationships. Integrating datasets allows for a comprehensive understanding of how manual withholding impacts tax compliance, perceptions of taxation, and voting habits.

Anticipated outcomes include insights into the nexus between manual withholding, tax attitudes, and voting patterns, with implications for tax policy formulation and understanding societal effects of gig economy dynamics. By bridging tax practices with public perception, this research contributes to informed policymaking and academic discourse.

Keywords: Economics, 1099 workers, Voting